Webinar - Best Planning Ideas Panel Discussion

January 25, 2021 from 12:00 - 1:00 pm.

About the Program

A panel of experts including Steve Gorin of Thompson Coburn LLP, John Scott of Anders and Michael Tessler of BUI, moderated by Kathleen Bilderback, will discuss the latest developments and the best estate, tax and business planning ideas of 2020. Topics will include how clients can maximize deductions and minimize threats to their businesses under what was originally named the Tax Cuts, various regulatory and administrative pronouncements regarding the care act and other recent developments in estate planning, and how to motivate clients to get into planning mode and act.

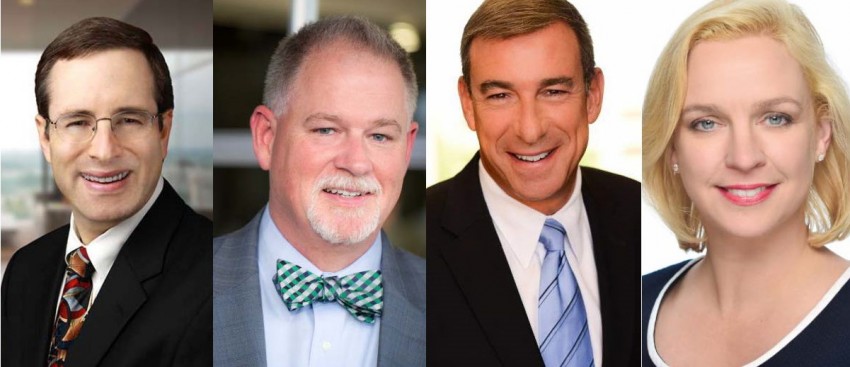

About the Speakers

Steven B. Gorin is a partner at Thompson Coburn LLP. He practices trust & estate law and helps owners structure closely-held businesses. Steve has practiced law for over 25 years and practiced accounting for 8 years before that. He is a member of the Business Planning Committee and chair of the Employee Benefits Committee of the American College of Trust & Estate Counsel and is chair of the Committee on Governmental Submissions for the American Bar Association's Real Property, Trust & Estate Law Section. Steve was inducted into the NAEPC Estate Planning Hall of Fame® in 2020.

John Scott is a partner in AMD's Tax Services Group and is active in Manufacturing and Distribution Services and Family Wealth and Estate Planning specialties. He offers dedicated resources and critical thinking to address complex issues in this industry, the hospitality and gaming industries and law firms. John has extensive experience in helping clients be more efficient, competitive and profitable. John also specializes in estate planning services at the firm with clients including individuals, families, law firms and owners.

Michael Tessler is a sought after resource by financial advisors all over the country. With experience in the home office and the field, his perspective and understanding of the life insurance business is broad. Today, Michael serves as the president at Brokerage Unlimited, Inc., a firm that assists financial service professionals with the implementation of wealth transfer and wealth protection strategies.

Kathleen W. Bilderback specializes in estate, business and executive benefits planning and estate and executive compensation planning with life insurance. Formerly, she was a member at of the Advanced Markets Group of MetLife, where she provided training and advanced underwriting support for the top producers of MetLife and its subsidiaries. Prior to joining GenAmerica Financial (a MetLife company) in 1996, she was in private practice.

Reservation Policy

All attendees are encouraged to register in advance. Meeting cost is $25 for members and $50 for guests. If you reserve and are unable to attend, please cancel your reservation at least 24 hours in advance of the meeting to receive a refund or a credit for a future meeting.

Continuing Education

EPCSTL has requested approval for continuing education in the following areas: Banking, Missouri Life & Health Insurance, MCLE and CFP.

EPCSTL is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit.

Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.learningmarket.org. Complaint resolution policy: please note your problem in the speaker evaluation.

CPE Learning Objectives

Upon completion of this course, you should be able to:

- effectively guide clients to some of the best tax planning ideas in the current environment.

Delivery Method: Group-live setting

Earn 1 CPE Credits for this session. Number of credit hours earned based on 50 minutes of talk. Change if more than one hour.

Field of Study: Specialized Knowledge and Applications

Program Level Overview

Prerequisites – There are no prerequisites or advanced preparation for this session – Change if there are any prerequisites.

Who should attend? Everyone at all levels

CFP

Program Summary: Topics include planning for the federal tax income, state income tax, asset protection, and the estate tax. The intent of the program is to provide planners with a number of ideas which may be particularly effective in the current environment.

Learning Objective(s): Upon completion of this course, you should be able to effectively guide clients to some of the best tax planning ideas in the current environment.

A certificate of completion will be available for those CTFAs, CPAs, and CWS designees who feel the program satisfies their continuing education requirements.

Click HERE for a full list of EPCSTL events.

Click HERE for the EPCSTL New Member Application.